Navigating the healthcare landscape: In today’s world, securing reliable and affordable health insurance is crucial for individuals and families. Covered California Health Insurance, the state’s official health insurance marketplace plays a vital role in facilitating access to comprehensive health coverage for millions of Californians.

Understanding Covered California Health Insurance

Understanding the intricacies of Covered California empowers you to:

- Make informed decisions: Regarding your health insurance needs and choose the most suitable plan that aligns with your budget and healthcare requirements.

- Navigate the Open Enrollment process: Efficiently, ensuring you don’t miss the deadline to enrol or make changes to your plan.

- Optimize your healthcare coverage: Select the plan that best suits your needs and potential financial assistance options.

- Experience potential financial security: By mitigating the financial burden associated with unexpected medical bills.

By understanding the information outlined in this guide, you can feel confident and empowered when navigating your healthcare options through Covered California.

Definition and Purpose of Covered California Health Insurance:

Covered California is the official health insurance marketplace established by the state of California under the Affordable Care Act (ACA). It serves as a facilitator, connecting individuals and families with a variety of private health insurance plans from reputable insurance companies operating within the state.

Explanation of How Covered California Health Insurance Works:

Covered California Health Insurance does not offer its insurance plans. Instead, it functions as a health insurance marketplace, connecting individuals and families with individual health insurance plans from participating private insurance companies. These companies are responsible for setting premiums, determining coverage details, and managing claims associated with the plans offered through Covered California Health Insurance.

Covered California establishes standards and regulations for the plans offered on the marketplace:

- Essential Health Benefits: All Covered California Health Insurance plans must cover ten essential health benefits as mandated by the ACA, ensuring comprehensive coverage for various healthcare needs.

- Network Adequacy: Plans must maintain an adequate network of qualified healthcare providers within the state to guarantee accessibility to care.

- Financial Solvency: Insurance companies participating in the marketplace must meet specific financial solvency requirements to ensure they can fulfil their obligations to policyholders.

Individuals can browse through various plan options, compare plans side-by-side, and enrol in their chosen plan directly through the Covered California Health Insurance platform or by contacting customer service.

Significance of Having Health Insurance Coverage:

Possessing health insurance through Covered California offers numerous benefits:

- Peace of mind: Knowing you have comprehensive healthcare coverage provides peace of mind, mitigating potential financial burdens in case of unexpected medical situations.

- Access to preventive care: Covered California plans typically cover preventive care services like routine checkups, screenings, and vaccinations, helping individuals maintain good health and potentially avoid more expensive future treatments.

- Access to a network of providers: Each plan includes a network of healthcare providers, ensuring you have access to qualified doctors, specialists, and hospitals within the network.

- Financial assistance: For individuals and families with low to moderate incomes, Covered California offers various financial assistance programs that can significantly reduce the cost of monthly premiums and out-of-pocket expenses.

Coverage Options under Covered California

Covered California offers a diverse range of health insurance plans to cater to the varying needs and budgets of individuals and families. Understanding the different types of plans and their associated benefits is crucial for making an informed choice.

Types of Health Insurance Plans Available Through Covered California:

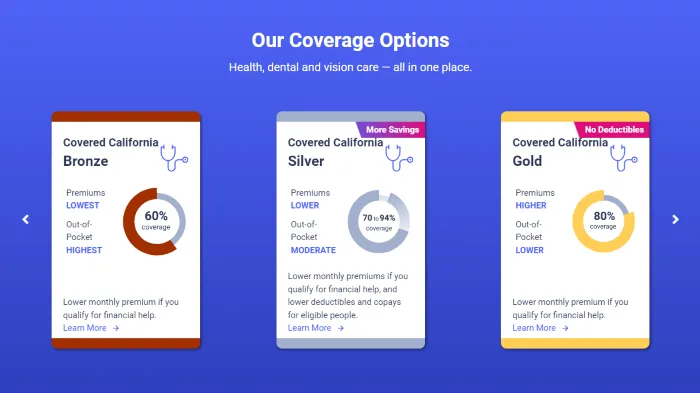

Covered California primarily offers individual health insurance plans, categorized by metal tiers, each offering varying levels of coverage and associated costs:

| Metal Tier | Monthly Premium | Deductible, Copay & Coinsurance | Ideal For |

|---|---|---|---|

| Bronze | Lowest | Highest | Generally healthy individuals/families anticipating minimal healthcare use. |

| Silver | Balanced | Moderate | Individuals/families seeking moderate coverage at an affordable price. |

| Gold | Moderate | Lower | Individuals/families anticipating more frequent healthcare use or desiring lower out-of-pocket costs. |

| Platinum | Highest | Lowest | Individuals/families requiring extensive healthcare services or preferring maximum financial protection. |

Overview of Coverage Levels and Benefits:

The specific benefits and coverage details can vary slightly between plans within the same metal tier and across different insurance companies. However, all Covered California Health Insurance plans must cover ten essential health benefits as mandated by the Affordable Care Act (ACA):

- Ambulatory patient services: Outpatient care provided by doctors and other healthcare professionals in an office setting.

- Emergency services: Medically necessary services to treat life-threatening emergencies.

- Hospitalization: Inpatient care provided in a hospital setting.

- Maternity and newborn care: Services related to pregnancy, childbirth, and care for newborns.

- Mental health and substance use disorder services: Outpatient and inpatient services for mental health and substance use disorders treatment.

- Prescription drugs: Coverage for certain prescription medications.

- Rehabilitative and habilitative services and devices: Services and devices designed to help individuals maintain or improve their ability to function.

- Laboratory services: Services for diagnostic testing, such as blood work and x-rays.

- Preventive and wellness services and chronic disease management: Services to prevent or manage chronic health conditions.

- Pediatric services: Services specifically for children, including dental and vision care (in some plans).

Importance of Selecting the Right Plan for Individual Needs:

Choosing the right plan depends on several factors:

- Age and health status: Consider your overall health and anticipated healthcare needs. If you are generally healthy and expect minimal healthcare utilization, a Bronze plan might suffice. However, if you have chronic health conditions or anticipate frequent healthcare use, a Gold or Platinum plan might be a better choice.

- Budget: Evaluate your monthly budget and determine the premium costs you are comfortable paying. While Bronze plans have lower premiums, they come with higher out-of-pocket expenses.

- Family size: Consider the number of individuals needing coverage and the specific needs of each family member.

- Preferred network of providers: Check if your preferred doctors and hospitals are included within the plan’s network.

By carefully considering these factors, you can choose the Covered California Health Insurance plan that best aligns with your individual needs and budget.

Are Hearing Aids Covered Under Covered California?

Hearing loss is a common concern affecting individuals of all ages. With the high cost of hearing aids, many seek clarification on whether Covered California insurance offers coverage for these devices.

Coverage for Hearing Aids Under Covered California Health Insurance:

Currently, Covered California does not directly cover the cost of hearing aids for adults. This applies to all plan types, regardless of metal tier. However, specific coverage details and limitations can vary depending on several factors:

- Plan details: While individual plans typically don’t cover hearing aids for adults, some plans may offer limited coverage for hearing tests or related services. It’s crucial to review your specific plan documents for any potential coverage details.

- Age: Some Covered California plans offer limited coverage for hearing aids for children under the age of 19 as mandated by state law.

- Medicare Advantage plans: If you are eligible for Medicare and choose a Medicare Advantage plan through Covered California, it might offer coverage for hearing aids. However, you’ll need to review the specific plan details to confirm.

Options for Obtaining Coverage for Hearing-Related Expenses:

While Covered California itself might not directly cover hearing aids, individuals have alternative options:

- Manufacturer rebates: Some hearing aid manufacturers offer discounts or rebates to specific groups like veterans or seniors.

- Charitable organizations: Certain organizations may offer financial assistance for hearing aids to individuals in need.

- Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs): If you have an FSA or HSA through your employer, you can utilize pre-tax funds from these accounts to cover the cost of hearing aids.

Finding the Best Solution:

To determine the right option for securing hearing aid coverage, you can:

- Review your plan documents: Carefully examine your specific Covered California Health Insurance plan details and benefits summary document provided by your chosen insurance company. Look for sections about hearing-related services or coverage exceptions.

- Contact your insurance company: Reach out to your insurance company’s customer service department directly by phone or through their website. They can verify your specific coverage details related to hearing aids and answer any questions.

- Explore external resources: Research online and contact hearing health providers to gather information on potential resources available for lowering the cost of hearing aids, including charities, non-profits, and any financing options.

Important to Remember: Even if your Covered California insurance plan does not directly cover hearing aids, it’s possible to utilize other avenues and resources to secure the coverage you or your loved ones need. It’s best to proactively seek clarification from your insurance provider, thoroughly explore your plan’s details and research external resources for potential financial aid.

Eligibility and Enrollment in Covered California

Even if you do not qualify for financial assistance, you might still be eligible to enrol in a Covered California plan at the full premium cost.

Understanding Eligibility:

Enrolling in a Covered California health insurance plan is not open to everyone. Knowing your eligibility status is crucial to proceeding with the enrollment process.

Criteria for Eligibility for Covered California Health Insurance:

To be eligible for Covered California health insurance, you must meet the following criteria:

- Residency: You must be a legal resident of California.

- Citizenship or immigration status: You must be a U.S. citizen or legal permanent resident, or meet specific immigration requirements outlined by Covered California.

- Income: Your household income must fall within a specific range to qualify for financial assistance programs or tax credits that help make the plans more affordable. You can utilize the eligibility tool on the Covered California website (https://www.coveredca.com/) to estimate your eligibility and potential financial assistance.

Important Note: Even if you do not qualify for financial assistance, you might still be eligible to enrol in a Covered California plan at the full premium cost.

Step-by-Step Guide to Enrolling in a Health Insurance Plan:

Once you have confirmed your eligibility, you can proceed with enrolling in a Covered California plan:

- Gather necessary documents: Collect documents like Social Security numbers for all household members applying for coverage, proof of income for all household members (pay stubs, tax returns, etc.), and documentation verifying immigration status (if applicable).

- Choose your enrollment method:

- Online enrollment: The Covered California website offers a user-friendly platform for browsing plans, comparing options, and completing the enrollment process electronically.

- Telephone enrollment: Contact Covered California customer service at 1-800-300-1506 to speak with a representative who can guide you through the enrollment process over the phone.

- In-person assistance: Schedule an appointment with a local enrollment counsellor who can provide personalized assistance and support throughout the enrollment process. You can find contact information for local enrollment counsellors on the Covered California website or by calling customer service.

- Complete the application form: Carefully follow the instructions and provide accurate information about your health status, dependents, preferred language, and chosen plan.

- Select a payment method: Choose your preferred method for paying your monthly premiums, such as direct debit or manual payments.

- Review and submit your application: Thoroughly review all information before submitting your application. You will receive a confirmation message or email with details about the next steps.

Deadlines and Important Dates for Enrollment:

Covered California operates within specific enrollment periods throughout the year. It’s crucial to be aware of these deadlines to avoid missing out on enrollment opportunities:

- Open Enrollment Period: This is the primary enrollment period when most individuals can enrol in a Covered California plan. It typically occurs from November 1st to January 31st of each year.

- Special Enrollment Period: Qualifying life events, such as job loss, marriage, or the birth of a child, can trigger a Special Enrollment Period, allowing you to enrol in a Covered California plan outside the Open Enrollment Period.

For the most current enrollment dates and deadlines, it’s recommended to refer to the official Covered California website or contact their customer service representatives for guidance.

Benefits and Services of Covered California

Covered California health insurance plans offer comprehensive coverage for various healthcare needs. Let’s delve into the specifics:

Overview of Essential Health Benefits Covered by Covered California Health Insurance:

All Covered California plans must cover ten essential health benefits as mandated by the Affordable Care Act (ACA). These benefits ensure comprehensive coverage for a wide range of healthcare needs:

| Category | Description | Example |

|---|---|---|

| Ambulatory patient services | Outpatient care from doctors and healthcare professionals. | Doctor visits, physical therapy. |

| Emergency services | Medically necessary care for life-threatening situations. | Emergency room visits, ambulance services. |

| Hospitalization | Inpatient care provided in a hospital setting. | Inpatient care is provided in a hospital setting. |

| Maternity and newborn care | Services related to pregnancy, childbirth, and newborn health. | Prenatal care, delivery, well-baby visits. |

| Mental health and substance use disorder services | Treatment for mental health and substance abuse issues. | Overnight stays for surgery, and treatment. |

| Prescription drugs | Coverage for certain medications prescribed by a doctor. | Antibiotics, antidepressants, life-saving medications. |

| Rehabilitative and habilitative services and devices | Services and devices to help manage disabilities. | Therapy, medication management, and addiction treatment programs. |

| Laboratory services | Diagnostic testing to diagnose and manage health conditions. | Blood tests, x-rays, MRIs. |

| Preventive and wellness services and chronic disease management | Services to prevent or manage chronic health problems. | Vaccinations, annual checkups, diabetes management programs. |

| Pediatric services | Services specifically for children (coverage varies by plan). | Well-child visits, immunizations, dental and vision care (in some plans). |

Note: This table provides a general overview of essential health benefits. Specific coverage details may vary depending on your chosen plan.

Explanation of Preventive Care Services:

Covered California plans typically cover a range of preventive care services aimed at maintaining good health and potentially avoiding more extensive future treatments. These services may include:

- Routine checkups and screenings: Annual physical exams, blood pressure checks, cholesterol screenings, certain cancer screenings, and more.

- Vaccinations: Immunizations recommended by the Centers for Disease Control and Prevention (CDC), such as flu shots, childhood vaccinations, tetanus, and others.

- Counseling and education: Guidance on maintaining a healthy lifestyle, making informed healthcare decisions, and managing specific health conditions.

Access to Mental Health Services and Prescription Medications:

Mental health and prescription drugs are essential components of comprehensive healthcare. Covered California plans address these needs by providing coverage for:

- Mental health services: Inpatient and outpatient mental health services such as therapy, counselling, and treatment for various mental health conditions.

- Substance use disorder treatment: Coverage includes services for individuals battling substance abuse and addiction, helping them overcome dependence and regain control of their lives.

- Prescription medications: Plans include coverage for a formulary (list) of approved prescription drugs. The specific drugs covered and associated costs can vary depending on the plan chosen.

Understanding Your Benefits:

To maximize the benefits of your Covered California plan, it’s essential to understand the specific details of your coverage. Here’s how:

- Review your plan documents: Refer to your plan’s benefits summary to understand exactly what services are covered and any associated costs like copays, coinsurance, and deductibles.

- Utilize the Covered California website: The Covered California website contains valuable information regarding the essential health benefits covered and resources for clarifying specific questions related to your plan.

- Contact your insurance company: Don’t hesitate to reach out to your insurance company’s customer service for clarification on any aspect of your coverage.

Understanding Premiums and Financial Assistance

Covered California health insurance plans offer comprehensive coverage, but associated costs require careful consideration. This section explores premiums, financial assistance options, and how to navigate these aspects.

Explanation of Costs Associated with Covered California Health Insurance Plans:

Understanding the various cost components is crucial for making informed decisions:

- Monthly Premium: This is the fixed monthly payment you make to your chosen insurance company to maintain your coverage. The premium amount varies depending on several factors:

- Plan type: Bronze plans generally have lower monthly premiums, while Gold and Platinum plans have higher premiums due to their more extensive coverage.

- Age: Younger individuals typically pay lower premiums than older individuals due to age-based rating practices.

- Geographic location: Premiums can vary slightly depending on your zip code and healthcare costs in your area.

- Tobacco use surcharge: Smokers or individuals who use tobacco products may face additional surcharges on their premiums.

- Deductible: This is the out-of-pocket amount you must pay for covered services before your insurance plan starts sharing the cost. Higher-deductible plans typically have lower monthly premiums, while lower-deductible plans come with higher premiums.

- Copay: This is a fixed dollar amount you pay for certain covered services, such as doctor visits or prescriptions after you’ve met your deductible.

- Coinsurance: This is a percentage of the cost of covered services that you share with your insurance company after meeting your deductible. For example, with a 20% coinsurance, you would pay 20% of the cost of a covered service, and your insurance plan would cover the remaining 80%.

Eligibility for Subsidies and Financial Assistance:

Covered California recognizes that accessing healthcare can be a financial burden for individuals and families with low to moderate incomes. To bridge this gap, they offer various financial assistance programs in the form of:

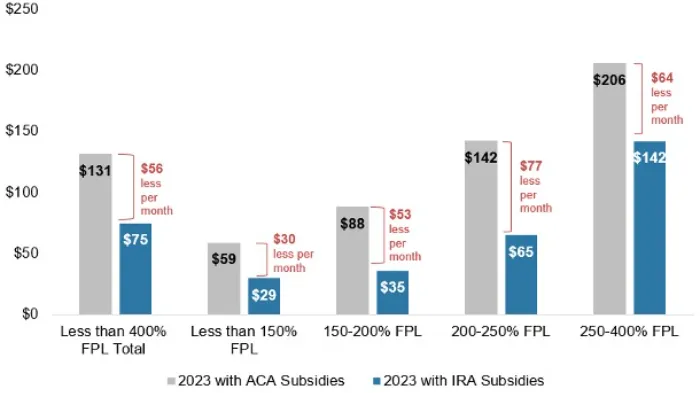

- Advanced Premium Tax Credits (APTCs): These tax credits directly subsidize your monthly premium costs, making coverage more affordable. Eligibility for APTCs is based on your household income and family size.

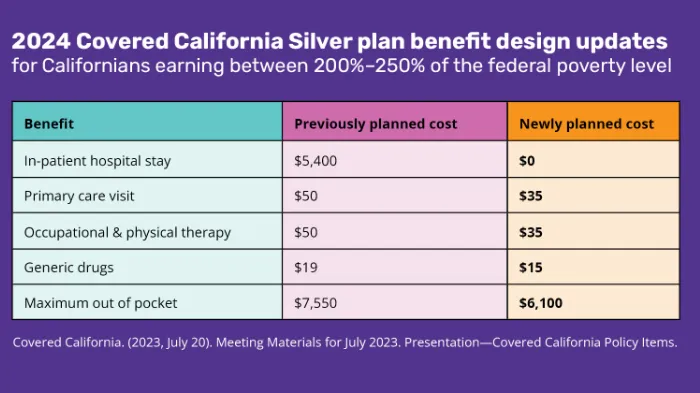

- Cost-Sharing Reductions (CSRs): These reductions help lower your out-of-pocket costs like deductibles, copays, and coinsurance. Eligibility for CSRs is based on your household income and the specific metal tier (Bronze, Silver, Gold, Platinum) of the plan you choose.

How to Apply for and Calculate Subsidies for Insurance Coverage:

Covered California offers a user-friendly online tool to estimate your eligibility for subsidies and calculate potential cost savings. Here’s how:

- Visit the Covered California website: (https://www.coveredca.com/)

- Utilize the eligibility tool: Locate the tool on the website and provide accurate information about your household income, family size, and other relevant details.

- Review the estimated benefits: The tool will provide an estimate of your potential monthly premium cost before and after applying for financial assistance.

Important to Note: Remember, the estimated figures are not a guaranteed offer. Your actual eligibility and subsidy amounts will be determined during the application process.

Finding Providers and Utilizing Your Coverage

Once enrolled in a Covered California plan, you can access healthcare services through participating providers within your plan’s network.

Finding Healthcare Providers Within the Covered California Network:

Covered California offers several tools to help you find healthcare providers within your plan’s network:

- Online provider directory: The Covered California website features a searchable directory where you can search for doctors, hospitals, and other healthcare providers based on your zip code, desired speciality, and insurance plan.

- Contact your insurance company: You can contact your insurance company’s customer service department for assistance in locating network providers in your area.

- Ask your current doctor: If you have a preferred doctor, inquire if they participate in your Covered California plan’s network.

Understanding Out-of-Network Coverage:

While Covered California encourages utilizing providers within your plan’s network for optimal cost-effectiveness, out-of-network coverage options are available. However, important considerations exist:

- Higher out-of-pocket costs: Out-of-network providers typically charge higher fees, and your insurance plan might have a lower reimbursement rate, resulting in higher out-of-pocket expenses for you.

- Prior authorization may be required: Your insurance company might require prior authorization before covering services rendered by out-of-network providers.

How to Schedule Appointments and Access Medical Services:

Once you’ve identified a preferred provider within your network, you can schedule appointments directly with their office. Remember to carry your insurance card whenever you access healthcare services to ensure proper identification and billing.

Additional Resources:

- Covered California website: The website offers valuable resources and information on finding providers, understanding your insurance coverage, and accessing a range of services.

- Insurance company support: Your insurance company’s website or customer service line can provide detailed information about your specific plan’s network, out-of-network coverage, and any specific instructions on how to schedule appointments.

Important Considerations:

- Check provider status regularly: It’s a good idea to check with your insurance company periodically to verify that a particular provider is still in-network, as networks can change.

- Emergencies: In cases of life-threatening emergencies, access the nearest emergency room for immediate care regardless of your insurance network. Your insurance plan typically provides some coverage for emergency care, even if received from an out-of-network provider.