Covered California Benefits play a pivotal role in ensuring Californians have access to comprehensive and affordable healthcare.

This guide delves into the various benefits of Covered California health insurance plans, empowering you to understand and utilise your coverage effectively.

Importance of Covered California Benefits:

Covered California benefits are crucial for several reasons:

- Financial protection: They help individuals and families manage the financial burden of healthcare costs by covering a significant portion of expenses associated with medical services.

- Improved access to care: By reducing financial barriers, covered individuals are more likely to seek preventive and necessary healthcare services, promoting overall well-being.

- Peace of mind: Knowing you have comprehensive health insurance coverage provides peace of mind and eliminates the worry of unexpected medical expenses.

Explanation of Covered California Benefit Categories:

Covered California plans adhere to essential health benefits (EHB) established by the federal government. These EHB categories encompass a wide range of services, ensuring individuals have access to necessary medical care. Here’s a breakdown of the key benefit categories:

| Benefit Category | Description |

|---|---|

| Ambulatory Patient Services (Outpatient Care) | Covers doctor visits, specialist consultations, diagnostic tests, and other services rendered outside a hospital setting. |

| Emergency Services | Covers medically necessary services to treat life-threatening emergencies, regardless of the healthcare provider or facility. |

| Hospitalization (Inpatient Care) | Covers services received during a hospital stay, including room and board, surgery, and other necessary hospital-based care. |

| Maternity and Newborn Care | Covers pregnancy, childbirth, and newborn care, including prenatal and postnatal care, delivery, and newborn hospital stays. |

| Mental Health and Substance Use Disorder Services | Covers treatment for mental health conditions and substance use disorders, including inpatient and outpatient therapy, medication management, and counseling. |

| Prescription Drugs | Covers a range of covered medications, with varying co-payments or deductibles depending on the specific plan. |

| Preventive and Wellness Services and Chronic Disease Management | Covers preventive care like screenings, immunizations, and wellness visits, along with services to manage chronic conditions like diabetes or heart disease. |

| Pediatric Services, including Dental and Vision Care (for children under 19) | Covers preventive and medically necessary dental and vision care services for children under the age of 19. |

Important Note: Specific coverage details, including co-pays, deductibles, and out-of-pocket limits, might vary depending on your chosen plan. Reviewing your plan documents and utilizing the Covered California website or contacting member support can help you gain a comprehensive understanding of your specific benefits.

Preview of the Guide’s Contents:

This guide explores various aspects of Covered California Benefits:

- Understanding Covered California Benefits: This section delves into the definition and purpose of Covered California benefits, emphasizing their significance for enrollees.

- Navigating Your Covered California Benefits: This section explores the different categories of Covered California benefits and provides resources for understanding your specific plan details.

- Maximizing Your Covered California Benefits: This section offers tips and resources for utilizing your Covered California benefits effectively, ensuring you receive the most out of your healthcare coverage.

- Obtaining Additional Support: This section outlines available resources for obtaining further information or assistance regarding Covered California benefits.

By understanding and effectively utilizing Covered California Benefits, individuals and families can experience improved access to quality healthcare and enjoy greater financial security in managing healthcare costs.

Understanding Covered California Benefits

Covered California Benefits refer to the comprehensive range of healthcare services covered by qualified health insurance plans offered through the Covered California marketplace. These benefits are designed to address various medical needs and ensure individuals have access to essential healthcare services.

Importance of Understanding Available Benefits for Enrollees:

Understanding the Covered California benefits associated with your chosen plan is crucial for several reasons:

- Informed healthcare decision-making: Knowing what your plan covers empowers you to make informed decisions about your healthcare needs and utilize services effectively.

- Managing healthcare costs: Familiarity with your plan’s co-pays, deductibles, and out-of-pocket limits allows you to budget for anticipated healthcare expenses and avoid unexpected financial burdens.

- Maximizing coverage utilization: Understanding covered services allows you to seek necessary preventive care, screenings, and treatment options to maintain your well-being.

Significance of Benefits in Providing Comprehensive Healthcare Coverage:

Covered California benefits serve as the foundation for comprehensive healthcare coverage, offering individuals and families financial protection and access to a range of essential medical services. By understanding your specific benefits, you can utilize your Covered California health insurance plan to its full potential, improving health outcomes and overall well-being.

Overview of Covered California Benefit Tiers

Covered California offers individuals and families a variety of health insurance plans categorized by benefit tiers. These tiers provide different levels of coverage and cost-sharing, allowing individuals to choose a plan that best fits their needs and budget.

Explanation of Covered California Benefit Tiers:

Covered California offers four primary benefit tiers:

- Bronze:

- Lowest monthly premiums: Bronze plans typically have the most affordable monthly premiums.

- Highest cost-sharing: Individuals enrolled in Bronze plans are responsible for more healthcare costs through deductibles, co-pays, and co-insurance.

- Example Covered Services: Preventive care, emergency services, hospitalization (potentially with high deductibles).

- Silver:

- Moderate monthly premiums: Silver plans offer a balance between premiums and cost-sharing compared to Bronze and Gold plans.

- Moderate cost-sharing: Individuals share some costs through co-pays and co-insurance, but typically to a lesser extent than Bronze plans.

- Example Covered Services: Preventive care, emergency services, hospitalization (potentially with lower deductibles than Bronze plans). Some Silver plans may offer additional benefits like vision or dental coverage.

- Gold:

- Higher monthly premiums: Gold plans generally have higher monthly premiums than Silver and Bronze plans.

- Lower cost-sharing: Individuals enrolled in Gold plans typically have lower out-of-pocket costs through lower deductibles, co-pays, and co-insurance compared to lower tiers.

- Example Covered Services: Preventive care, emergency services, hospitalization with lower deductibles and co-pays, potentially including additional benefits like vision or dental coverage.

- Platinum:

- Highest monthly premiums: Platinum plans offer the most comprehensive coverage and come with the highest monthly premiums.

- Lowest cost-sharing: Individuals enrolled in Platinum plans typically have the lowest out-of-pocket costs with minimal deductibles, co-pays, and co-insurance.

- Example Covered Services: Comprehensive coverage for preventive care, emergency services, hospitalization, and potentially additional benefits like vision, dental, and mental health coverage.

Table: Comparison of Covered California Benefit Tiers

| Benefit Tier | Monthly Premium | Cost-Sharing | Example Covered Services |

|---|---|---|---|

| Bronze | Lowest | Highest | Preventive care, emergency services, hospitalization (high deductibles) |

| Silver | Moderate | Moderate | Preventive care, emergency services, hospitalization (moderate deductibles), potential additional benefits (vision, dental) |

| Gold | Higher | Lower | Preventive care, emergency services, hospitalization (lower deductibles, co-pays), potential additional benefits (vision, dental) |

| Platinum | Highest | Lowest | Comprehensive coverage for preventive care, emergency services, hospitalization, vision, dental, mental health (potentially additional benefits) |

Important Note: Remember that specific details like covered services, co-pays, deductibles, and out-of-pocket limits can vary depending on the specific plan within each tier. Always refer to your plan documents or contact Covered California Member Support for accurate information regarding your chosen plan.

Which Benefit is Free Across All Tiers in Covered California?

While all Covered California plans offer preventive care at no cost, it’s crucial to understand that cost-sharing:

- May still apply: Even for preventive care, some plans might require co-pays for specific services like office visits.

- Varies across tiers: The cost-sharing structure differs among benefit tiers. For instance, some Silver plans offer preventive care with $0 co-pays, while others might have minimal co-pays.

- Is subject to plan variations: Even within the same tier, specific plans might have slight variations in cost-sharing for preventive care services.

Therefore, while preventive care is generally a covered benefit across all tiers, it’s essential to:

- Review your specific plan documents to understand the details of cost-sharing for preventive care services.

- Utilize the Covered California website or contact member support for further clarification on cost-sharing associated with preventive care in your specific plan.

By understanding the differences in cost-sharing across benefit tiers and specific plans, individuals can make informed decisions when choosing a Covered California health insurance plan that aligns with their needs and budget.

Essential Health Benefits Covered by Covered California

Covered California plans provide a comprehensive safety net through essential health benefits (EHBs) established by the federal government. These EHB categories encompass a wide range of healthcare services, ensuring individuals and families have access to necessary medical care.

Key Essential Health Benefits:

Here’s a detailed breakdown of key essential health benefits included in all Covered California plans:

- Preventive and Wellness Services:

- Annual physical exams and screenings (e.g., mammograms, colonoscopies)

- Immunizations (flu shots, childhood vaccinations)

- Well-child visits and developmental screenings

- Weight loss counseling and smoking cessation programs

- Ambulatory Patient Services (Outpatient Care):

- Doctor’s office visits (primary care and specialists)

- Lab tests and X-rays

- Mental health and substance use disorder treatment

- Physical therapy and rehabilitation services

- Hospitalization (Inpatient Care):

- Hospital room and board

- Surgery and anaesthesia

- Intensive care (ICU) stays

- Medically necessary inpatient mental health and substance use disorder treatment

- Emergency Services:

- Emergency room visits and ambulance transportation

- Treatment for life-threatening conditions regardless of the healthcare provider or facility

- Maternity and Newborn Care:

- Prenatal checkups and ultrasounds

- Labor and delivery services

- Hospital stay for mother and newborn

- Well-baby checkups and immunizations

- Prescription Drugs:

- Coverage for a range of medications included in a plan’s formulary (list of covered drugs)

- Co-pays or co-insurance required for certain medications

- Pediatric Services, including Dental and Vision Care (for children under 19):

- Dental cleanings, fillings, and extractions

- Eye exams and glasses or contacts

- Hearing tests and hearing aids (limited coverage)

By understanding the essential health benefits covered by Covered California, individuals and families can make informed decisions when choosing a plan that best suits their healthcare needs and financial circumstances.

Significance of Essential Health Benefits:

Essential health benefits play a crucial role in ensuring comprehensive healthcare coverage by providing coverage for:

- Preventive care: Early detection and management of potential health issues, potentially reducing the need for expensive treatments later.

- Necessary medical services: Access to a broad range of services, offering peace of mind and addressing various healthcare needs.

- Financial protection: Coverage helps manage healthcare costs, mitigating the financial burden associated with medical expenses.

By understanding the essential health benefits covered by Covered California, individuals and families can make informed decisions when choosing a plan that best suits their healthcare needs and financial circumstances.

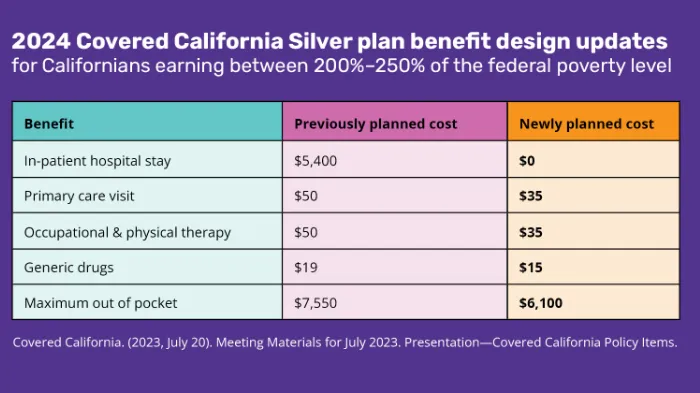

Cost-Sharing Reductions for Covered California Benefits

Covered California recognizes the importance of affordability and offers cost-sharing reductions (CSRs) to eligible individuals and families enrolled in Silver-tier plans. CSRs help reduce the amount individuals owe for certain healthcare costs, making coverage more accessible.

Eligibility for Cost-Sharing Reductions:

Eligibility for CSRs is determined based on household income and family size. Individuals and families with incomes between 138% and 400% of the federal poverty level (FPL) might qualify for CSRs. You can utilize the Covered California website or contact member support to determine your eligibility and estimate potential savings.

Benefits of Cost-Sharing Reductions:

Cost-sharing reductions can significantly lessen the financial burden associated with healthcare by:

- Lowering monthly premiums: Individuals receiving CSRs might experience lower monthly premium payments for their Silver-tier plans.

- Reducing deductibles: CSRs can help lower deductibles, the amount individuals need to pay out-of-pocket before their insurance starts covering costs.

- Lowering co-pays and co-insurance: CSRs can also reduce co-pays (a fixed dollar amount) and co-insurance (a percentage of the cost) owed for covered services.

By reducing cost-sharing, CSRs make Covered California plans more affordable and accessible to a wider range of individuals and families, promoting greater access to essential health benefits.

Additional Benefits Offered by Covered California

While essential health benefits (EHBs) form the core of Covered California plans, some plans offer additional benefits beyond these mandatory categories. These supplemental benefits address diverse healthcare needs and enhance overall coverage.

Examples of Supplemental Benefits:

- Dental care: Coverage for routine cleanings, fillings, and certain other dental procedures, often for children under 19 and sometimes for adults depending on the plan.

- Vision care: Coverage for eye exams, eyeglasses or contacts, and sometimes additional services like vision therapy.

- Mental health and substance use disorder services: Coverage beyond what’s mandated under EHBs, potentially including additional outpatient therapy sessions, inpatient treatment, or specific medications.

Importance of Supplemental Benefits:

Supplemental benefits play a crucial role in:

- Addressing diverse healthcare needs: These benefits can cater to specific needs like dental or vision care, promoting overall well-being.

- Enhancing preventive care: Coverage for services like dental cleanings and vision exams can help prevent future health issues and potentially reduce overall healthcare costs.

- Improving access to mental health care: Increased coverage for mental health services can encourage individuals to seek necessary help and manage mental health concerns more effectively.

Important Note:

- Availability and extent of coverage: Availability and extent of supplemental benefits vary depending on the specific plan you choose.

- Cost considerations: Plans with broader supplemental benefits typically have higher monthly premiums or out-of-pocket costs.

Carefully review plan details and consider your needs to determine if supplemental benefits are essential.

How to Maximize Covered California Benefits

Covered California plans offer a vast range of benefits. Here are some tips to help you maximize your coverage:

Utilize Preventive Care Services:

- Schedule regular preventive care checkups: Early detection and management of potential health issues can prevent more serious problems and potentially reduce future healthcare costs.

- Get recommended screenings: Take advantage of covered preventive screenings like mammograms, colonoscopies, and others to maintain good health.

- Stay informed about covered services: Review your plan documents and utilize the Covered California website or member support to understand which preventive care services are covered at no cost.

Understand Coverage Limits and Out-of-Pocket Costs:

>> Review your plan documents: Familiarize yourself with your plan’s deductible, co-pays, and co-insurance. These determine how much you pay out-of-pocket for covered services.

>> Budget for healthcare costs: Understanding your potential out-of-pocket costs allows you to budget effectively and prepare for healthcare expenses.

>> Seek clarification: If you have questions about coverage limits or out-of-pocket costs, don’t hesitate to contact Covered California member support for assistance.

Additional Resources:

- Covered California website: Provides information on available plans, benefits, and resources for enrollees.

- Member Support: Offers personalized guidance and assistance with understanding your coverage and navigating the healthcare system.

- Patient advocate organizations: Can provide support and guidance in understanding benefits, navigating healthcare systems, and advocating for your rights.

Enrollment Periods for Covered California Benefits

Understanding enrollment periods is crucial for individuals and families seeking to enrol in Covered California and access its benefits. This section explains different enrollment periods and their significance.

Open Enrollment Period:

The open enrollment period is the designated timeframe each year when anyone can apply for a Covered California health insurance plan, regardless of their health status or prior coverage.

Enrolling during the open enrollment period is essential for individuals seeking new coverage or wanting to switch plans for the following year.

Open enrollment periods generally occur between November and January each year. Specific dates may vary from year to year, so it’s crucial to stay updated and check the Covered California website for the most recent information.

Special Enrollment Period:

- Definition: Special enrollment periods allow individuals and families to enrol outside the open enrollment period under specific qualifying life events.

- Qualifying life events: These events typically involve significant changes in an individual’s or family’s circumstances, such as:

- Loss of employer-sponsored health insurance

- Marriage, divorce, or domestic partnership changes

- Birth, adoption, or placement of a child in foster care

- Involuntary change in residence

- Eligibility for certain government benefits (e.g., Medi-Cal)

- Importance: Special enrollment periods offer an opportunity to obtain coverage when experiencing significant life changes that affect your health insurance needs.

- Eligibility criteria: Each qualifying life event has specific eligibility criteria and timeframes for enrollment. You can find details on the Covered California website or by contacting member support.

Remember: Missing enrollment deadlines can result in a coverage gap and potentially lead to higher premiums when enrolling outside these designated periods.