This guide delves into the Covered California income limits, a crucial aspect of determining access to affordable health insurance through the state’s marketplace.

In the ever-changing landscape of healthcare, understanding your eligibility for various programs can be daunting.

Understanding Covered California Income Limits

Knowing the income guidelines associated with Covered California is vital for individuals and families seeking financial assistance with their healthcare plan. These guidelines establish who qualifies for subsidies and tax credits that can significantly reduce the cost of monthly premiums.

Without this understanding, individuals may miss out on valuable benefits that make quality healthcare more attainable.

Definition and Purpose of Income Limits in Covered California:

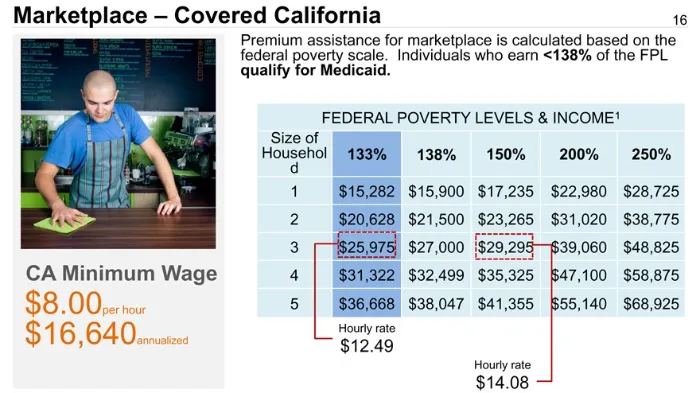

Covered California income limits establish the maximum household income level that allows individuals and families to qualify for financial assistance in the form of premium tax credits and cost-sharing reductions when purchasing health insurance through the marketplace. These limits are based on the Federal Poverty Level (FPL), a national standard that measures income relative to the poverty line in the United States.

Explanation of How Income Limits Determine Eligibility for Benefits:

Covered California Income Limits utilizes the Federal Poverty Level (FPL) guidelines from the previous year to determine eligibility for its programs. This means that the 2023 FPL guidelines assess eligibility for the 2024 enrollment period.

Here’s a breakdown of how income and FPL percentages translate into eligibility:

- Individuals and families with incomes below 138% of the FPL typically qualify for Medi-Cal, California’s Medicaid program, which provides free or low-cost health coverage.

- Individuals and families with incomes between 138% and 400% of the FPL may qualify for subsidies to help lower their monthly health insurance premiums through Covered California. The amount of financial assistance received depends on your specific income level and household size.

Significance of Covered California Income Limits for Accessing Healthcare Coverage:

Covered California Income Limits play a crucial role in expanding access to affordable health insurance for Californians. By providing financial assistance to individuals and families within specific income brackets, the program helps bridge the gap between the cost of healthcare and the ability to afford it. This allows more Californians to gain access to essential health coverage, promoting preventative care, early diagnosis, and overall well-being.

What Are the Income Limits for Covered California?

Understanding the income limit threshold for Covered California is crucial for determining your eligibility for financial assistance with your health insurance plan. This section will clarify these limits and factors influencing eligibility.

Explanation of the Income Limit Threshold for Covered California:

Covered California’s income limits are based on the Federal Poverty Level (FPL), a national standard that measures income relative to the poverty line in the United States. However, Covered California Income Limits uses the FPL guidelines from the previous year to determine eligibility for its programs.

Here’s a breakdown of the income limits for 2024, based on the 2023 FPL percentages:

| Household Size | Maximum Annual Income | Percentage of FPL |

|---|---|---|

| 1 | $33,975 | 400% |

| 2 | $45,525 | 400% |

| 3 | $57,075 | 400% |

| 4 | $69,375 | 400% |

| 5 | $81,675 | 400% |

| 6 | $93,975 | 400% |

| 7 | $106,275 | 400% |

| 8 | $118,575 | 400% |

Factors Influencing Income Limits Eligibility:

Several factors influence your eligibility for financial assistance based on Covered California’s income limits:

- Household Size: The number of people living in your household directly impacts your income limit threshold. As the household size increases, the maximum income limit also increases.

- Income Type: Covered California considers most forms of income when determining eligibility, including wages, salaries, unemployment benefits, pensions, Social Security, and interest income.

- Immigration Status: While immigration status doesn’t directly affect eligibility for Covered California itself, it can impact your ability to qualify for specific financial assistance programs.

How to Determine if You Meet the Income Requirements for Covered California:

There are two primary ways to determine if you meet the income requirements for Covered California:

- Covered California Eligibility Tool: The Covered California Income Limits website offers an eligibility tool that allows you to estimate your potential eligibility for financial assistance based on your estimated household income and size.

- Apply for Coverage: When you apply for coverage through Covered California Income Limits, you will be prompted to provide detailed information about your household income. The system will then automatically assess your eligibility for financial assistance based on the information you provide.

Guidelines for Determining Income for Covered California

Understanding what constitutes income for Covered California purposes is crucial for accurately assessing your eligibility.

Explanation of What Constitutes Income for Covered California Purposes:

Covered California Income Limits considers most forms of income when determining eligibility, including:

- Wages and salaries from employment

- Self-employment income

- Unemployment benefits

- Social Security benefits

- Retirement income (pensions, IRAs)

- Interest income (dividends, savings account interest)

- Alimony and child support received

Types of Income Considered for Eligibility Determination:

It’s important to note that not all types of income are considered when determining your eligibility for Covered California Income Limits. Some exclusions or deductions may apply, such as:

- Means-tested benefits: Public assistance programs like the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF) are not counted as income.

- Housing assistance: Housing subsidies like housing choice vouchers are not considered income.

- Certain tax deductions: Some deductions, like student loan interest and childcare expenses, may be deducted from your total income.

For a comprehensive list of exclusions and deductions, it’s recommended to refer to the official Covered California website or consult with a certified enrollment counsellor.

How Covered California Income Limits Are Calculated

Covered California Income Limits utilizes the Federal Poverty Level (FPL) guidelines from the previous year to determine eligibility for its programs. The 2023 FPL guidelines will be used to assess eligibility for the 2024 enrollment period.

Here’s a breakdown of the calculation process:

- Gather your income information: You will need your modified adjusted gross income (MAGI) from your most recent tax return. This figure reflects your taxable income after accounting for certain deductions and adjustments.

- Determine your household size: This includes all individuals who are financially dependent on you, such as your spouse, children, and any dependents you claim on your tax return.

- Compare your income and household size: Refer to the income limit chart provided by Covered California Income Limits, which categorizes income limits based on household size as a percentage of the FPL.

>> Example 1: Single Individual with Steady Income

- Household size: 1

- MAGI: $30,000

- FPL Percentage: Referring to the chart, we find that the income limit for a single individual is 400% of the FPL.

- Eligibility: Since $30,000 falls below this threshold, this individual is likely eligible for financial assistance through Covered California Income Limits.

>> Example 2: Family of Four with Income Fluctuations

- Household size: 4

- MAGI: $70,000 (represents an average for the year, with income temporarily higher at certain points)

- FPL Percentage: The income limit for a family of four is also 400% of the FPL.

- Eligibility: While the average income falls within the limit, the temporary income fluctuations might require closer evaluation by Covered California to determine actual eligibility.

Importance of Accurate Income Reporting:

Providing accurate and complete income information is crucial for receiving the correct level of financial assistance and ensuring continued eligibility throughout the coverage year. Any discrepancies discovered later can lead to adjustments in your subsidy or potential repayment requirements.

What is the Income Limit for Covered California?

Income limits serve as a gateway for accessing various Covered California benefits:

Individuals and families with incomes below 138% of the FPL typically qualify for Medi-Cal, California’s Medicaid program, which provides free or low-cost health coverage.

Individuals and families with incomes between 138% and 400% of the FPL may qualify for subsidies to help lower their monthly health insurance premiums through Covered California Income Limits. The amount of financial assistance received depends on your specific income level and household size.

Consequences of Exceeding Income Limits:

- Exceeding the income limit thresholds: Individuals who exceed the income limits established by Covered California will not be eligible for financial assistance through subsidies or cost-sharing reductions.

- Consequences: You can still purchase a plan through Covered California at the full cost without any financial assistance.

Options for Individuals Who Do Not Meet Income Requirements:

- Full-cost plan options: Individuals who fall outside the income limits can still enrol in a Covered California plan at the full premium cost. These plans offer a range of benefits and cater to various needs.

- Exploring alternative options: Individuals who do not qualify for Covered California Income Limits due to income or immigration status may want to explore other avenues for health insurance coverage, such as employer-sponsored plans, Medicaid expansion programs in other states, or private insurance companies.

Process for Verifying Income for Covered California Application

Covered California utilizes various methods to verify your income and determine your eligibility for financial assistance. Here’s a breakdown of the process:

- Initial application: When applying for Covered California, you will be asked to provide your MAGI from your most recent tax return.

- Verification methods: Covered California may utilize several methods to verify your income, including:

- Electronically retrieving your tax information directly from the IRS: This is the preferred method as it is fast and efficient.

- Requesting documentation: You may be required to submit pay stubs, W-2 forms, tax returns, or other income verification documents.

- Contacting your employer or other third parties: In some cases, Covered California Income Limits may directly contact your employer or other relevant parties to verify your income information.

What is the Income Limit for Covered California? It’s important to note:

- The specific verification method used will depend on your circumstances and the information you provide.

- Cooperating with the verification process is essential to ensure the timely processing of your application and accurate determination of your eligibility.

Documentation Required to Verify Income

While the specific documents required may vary, here are some examples of common income verification documents accepted by Covered California:

| Document Category | Example | Description |

|---|---|---|

| Federal Tax Returns | Form 1040, W-2 Forms | Provides a comprehensive overview of your income and deductions from the previous tax year. |

| Pay Stubs | Most recent pay stubs | Documents your current income and employment status. |

| Self-Employment Income Documentation | Business licenses, income statements, tax schedules | Verifies income earned through self-employment ventures. |

| Social Security Statements/Benefit Letters | Documents from the Social Security Administration | Confirms income received from Social Security or other government assistance programs. |

Note: This table provides a general overview. Specific requirements may vary depending on your situation. Always refer to Covered California’s official website or consult with an agent for the most up-to-date information.

Resources Available for Assistance with Income Verification

Covered California offers various resources to assist you with the income verification process:

- Online resources: The Covered California website provides detailed information about acceptable documentation and the verification process. You can also find FAQs and tutorials to guide you through the steps.

- Customer service representatives: Representatives are available by phone at 1-800-300-1506 to answer your questions and offer personalized assistance.

- Enrollment centres: Local enrollment centres can provide in-person guidance on the application process and income verification requirements.

Remember: Having complete and accurate documentation readily available will streamline the verification process and ensure a smooth application experience.

Updates to Covered California Income Limits

Covered California income limits are subject to annual adjustments based on changes in the Federal Poverty Level (FPL). Understanding these adjustments and their potential impact on your eligibility is crucial.

Changes and Updates to Income Limits for the Current Year

For the 2024 enrollment period (effective January 1, 2024):

- Covered California utilizes the 2023 FPL guidelines to determine eligibility.

- The income limit thresholds have seen some minor adjustments compared to the previous year.

- You can find the updated income limit chart on the Covered California website for accurate information.

Impact of Changes on Eligibility for Covered California Benefits

- Changes in income limits: These adjustments may impact your eligibility for financial assistance depending on your household size and income level.

- Increased income limits: If the income limit for your household size has increased, you might become newly eligible for financial assistance.

- Decreased income limits: If the income limit for your household size has decreased, you might no longer qualify for the same level of financial assistance or may lose eligibility altogether.

Resources for Staying Updated on Income Limit Changes

Staying informed about potential changes to Covered California income limits is essential:

- Covered California website: The website is regularly updated with the latest information on income limits and other program updates.

- Email Subscription: You can subscribe to email notifications from Covered California Income Limits to receive updates directly.

- Social media: Following Covered California on social media can also keep you informed about important announcements and changes.

Applying for Covered California Benefits Based on Income

Having a clear understanding of Covered California’s income limits empowers you to take the next step: applying for benefits. This section outlines the application process, emphasizes the importance of accurate income reporting, and highlights available assistance resources.

Step-by-Step Guide to Applying for Covered California Benefits

Applying for Covered California Income Limits benefits based on income involves following these key steps:

1. Gather your documents:

- Proof of income: This could include tax returns, pay stubs, or other documentation as specified by Covered California.

- Proof of citizenship or legal immigration status (if applicable): This is required for individuals seeking financial assistance.

- Social Security numbers for all household members applying for coverage.

2. Choose your preferred method of application:

- Online: The Covered California website (https://www.coveredca.com/) offers a user-friendly online application portal.

- Phone: You can call Covered California’s customer service at 1-800-300-1506 to complete your application over the phone with the help of a representative.

- In-person: Visit a local enrollment centre to receive personalized assistance with the application process from trained professionals.

3. During the application process, provide accurate information:

- Income details: This is crucial for determining your eligibility for financial assistance and ensuring you receive the correct level of subsidy.

- Household information: Accurately report the number of individuals in your household who will be covered under the plan.

- Contact information: Ensure you provide accurate contact details for effective communication throughout the process.

4. Submit your application and supporting documents:

Once you have completed the application and gathered all required documents, submit them through your chosen method.

5. Wait for a response: Covered California Income Limits will process your application and determine your eligibility for financial assistance and coverage options. You will receive a notification outlining the outcome and your next steps.

Importance of Accurate Income Reporting

Accurate income reporting is of paramount importance in the application process for several reasons:

- Eligibility determination: Your income directly impacts your eligibility for financial assistance and the specific subsidies you may qualify for.

- Benefit accuracy: Incorrect income information can lead to receiving inaccurate financial assistance, potentially resulting in overpayment or underpayment situations which can lead to adjustments or repayment requirements later.

- Maintaining coverage: Any discrepancies discovered in your income information can affect your continued eligibility and potentially lead to coverage termination.

Therefore, it is crucial to provide truthful and complete information about your income during the application process and throughout your coverage period.

Assistance Available for Completing the Application Based on Income Limits

Covered California offers various resources to assist you in completing your application based on income limits:

| Resource | Description | Benefit |

|---|---|---|

| Online Resources | – Detailed instructions & guides tailored to income-based applications. | – Apply with ease and get step-by-step guidance specific to your situation. |

| Customer Service | – Call 1-800-300-1506 to speak with a representative. | – Get personalized assistance, ask questions, and receive clear guidance throughout the process. |

| Enrollment Centers | – Trained professionals offer in-person guidance and assistance. | – Gain personalized support, navigate complexities, and ensure accurate income verification. |

By understanding the application process, the importance of accurate income reporting, and the available resources, you can navigate your journey towards securing affordable health insurance through Covered California Income Limits with greater confidence.

Appeals Process for Covered California Income Limits

While Covered California strives for accuracy, there might be situations where individuals disagree with the income limit determination affecting their eligibility for benefits. This section explores the appeals process available for such situations.

Overview of the Appeals Process

The appeals process allows individuals to challenge a decision made by Covered California regarding their income limit determination. This process provides an opportunity to present additional evidence and ensure a fair and accurate assessment of your eligibility.

Steps to File an Appeal Regarding Income Limits

1. Request a hearing: Contact Covered California and formally request a hearing to appeal the income limit decision.

2. Submit supporting documentation: Gather and submit any additional documentation that supports your income claim, such as updated tax returns, pay stubs, or verifications from employers or government agencies.

3. Attend the hearing: You have the right to attend the hearing and present your case to a neutral reviewer.

Rights and Options Available to Individuals During the Appeals Process

Throughout the appeals process, you have the following rights and options:

- Representation: You may choose to have a lawyer or other authorized representative assist you during the appeals process.

- Review the information: You have the right to review all information that Covered California used to make its decision about your income limits.

- Present your case: You have the opportunity to explain your position and present evidence to support your claim.

- Fair and impartial review: The hearing will be conducted by a fair and impartial reviewer who will consider all the information presented.

Possible Outcomes of the Appeals Process:

- Appeal Approved: If your appeal is successful, Covered California Income Limits may adjust your income limit determination and recalculate your eligibility for financial assistance.

- Appeal Denied: If the appeals reviewer upholds Covered California’s original decision, your benefits eligibility will remain as originally determined.

Additional Considerations:

- Timeliness is key: There are specific timelines for filing an appeal. It’s important to act quickly to ensure your appeal rights are preserved.

- Seek assistance: If you are considering appealing an income limits decision, it’s advisable to consult with an enrollment centre representative, a legal aid professional, or another qualified expert who can help you understand the process and advocate for your case.